Real Estate Syndication Structures- A Simple Guide

Table of Contents

- What is a Real Estate Syndication?

- A real estate syndication occurs when various investors pool together their resources, capital, and skills to purchase a real estate property.

- Who’s Involved in Real Estate Syndications?

- Types Of Real Estate Syndication Structures

- Straight Split – Real Estate Structure

- Waterfall Structure – Real Estate Syndication Structure

- WATERFALL STRUCTURE EXAMPLE:

- The first return hurdle is to pay the real estate syndication’s passive investors a 7% preferred return; when this goal has been met, the structure of the syndication changes to an 80/20 straight split. This continues until the 15% rate of return threshold is met. When the 15% return hurdle is met, this activates a 50/50 straight split in which profits are equally divided among both passive investors and the general partners in the real estate syndication.

- WATERFALL STRUCTURE EXAMPLE:

- What is the Best Real Estate Syndication Structure?

- Final Thoughts on Real Estate Syndication Structures

- If you are interested in investing in multifamily real estate syndications with Disrupt Equity, please fill out our investment form to be notified of our upcoming apartment investment opportunities.

- If you are interested in investing in multifamily real estate syndications with Disrupt Equity, please fill out our investment form to be notified of our upcoming apartment investment opportunities.

What is a Real Estate Syndication?

Real estate syndications have become increasingly popular as real estate investors seek to diversify their investment portfolios. One of the most important things to understand as an investor in real estate syndication is how the syndication is structured.

In this post, we’ll go through how to analyze the real estate syndication structure, which determines how the property’s profits are divided between passive investors and the real estate syndication company.

Before we get into how real estate syndications are structured, let’s define what a real estate syndication is.

A real estate syndication occurs when various investors pool together their resources, capital, and skills to purchase a real estate property.

Real estate syndications can occur with a variety of asset classes, including:

- apartment buildings

- mobile home parks

- land

- self-storage

& more!

Who’s Involved in Real Estate Syndications?

There are two parties involved in the real estate syndication, The General Partners, commonly referred to as real estate syndicators, and the Limited Partners, widely referred to as passive investors.

The General Partners in the syndication will do the work of finding the deal, raising the capital, and once the deal closes, ensuring the investment is lucrative to investors!

The Limited Partners are responsible for providing the capital for the real estate syndication. Once the deal is closed, passive investors will not have active responsibilities in managing the asset.

When it comes to real estate syndications, there are many ways you can structure a project. The structure will depend on the General Partner’s experience, track record, the specific deal, the market, as well as many other factors.

The way a real estate syndication is structured will affect the returns for passive investors, which is a significant reason why passive investors (LPs) must understand the types of real estate syndication structures.

Let’s get into a few of the most common ways that real estate syndications are structured.

Types Of Real Estate Syndication Structures

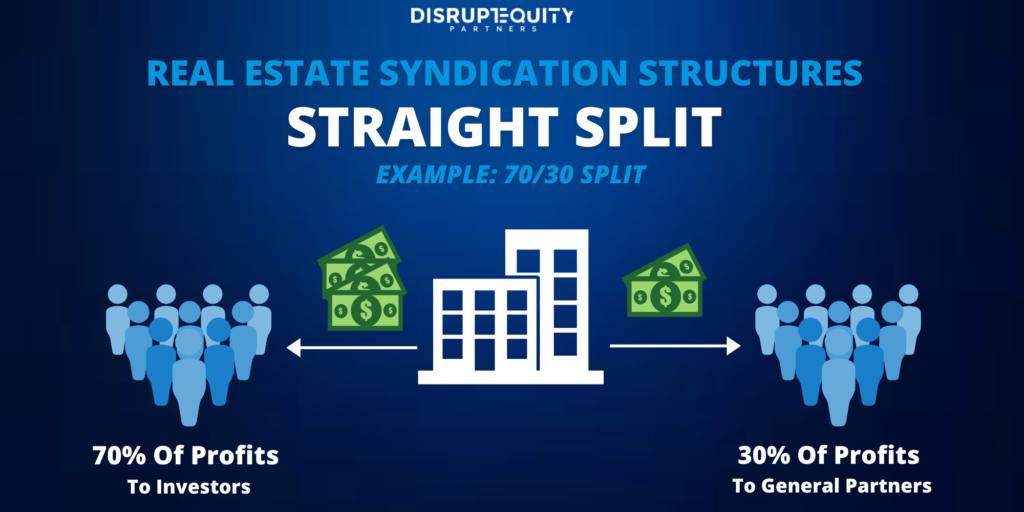

Straight Split – Real Estate Structure

One of the simplest and straightforward syndication structures for paying out the real estate syndication profits is called a straight split.

With a straight split structure, any profits from the asset are split according to the ownership percentage of the investors and general partners.

The same percentage split is used for all returns that the syndication generates. cash flow, capital gains after the sale of the property, etc.).

A common example of the straight split syndication structure would be a 70/30 split, meaning 70% of profits would go to the syndications passive investors and 30% would go to the general partners.

For example, with a straight split of 70/30, if a real estate syndication generates $200,000 in profits, the sponsor will take their 30% or $60,000 and the remaining $140,000 will be split evenly amongst the passive investors.

Waterfall Structure – Real Estate Syndication Structure

A waterfall structure is another common way of structuring a real estate syndication. The waterfall structure allows for an uneven payout distribution when certain investor return hurdles are met.

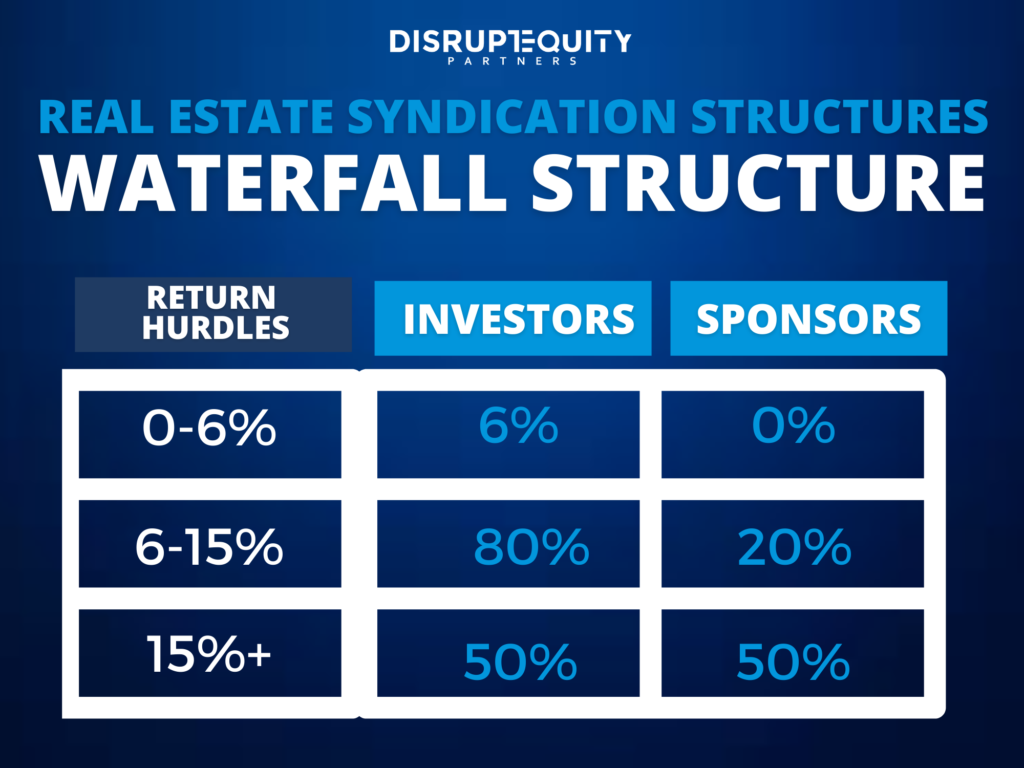

Below is an example of what a waterfall structure in a real estate syndication may look like:

WATERFALL STRUCTURE EXAMPLE:

The first return hurdle is to pay the real estate syndication’s passive investors a 7% preferred return; when this goal has been met, the structure of the syndication changes to an 80/20 straight split. This continues until the 15% rate of return threshold is met. When the 15% return hurdle is met, this activates a 50/50 straight split in which profits are equally divided among both passive investors and the general partners in the real estate syndication.

Please take a look at this waterfall example outlined in the graphic below.

The waterfall structure is a widespread real estate syndication structure and most often will start with a preferred return to investors.

Including a preferred return in the real estate syndication structure is a great benefit to passive investors. Preferred returns in real estate syndication structures will typically range from 5-10%.

Preferred returns require that the real estate syndication pay out a set return rate to passive investors before the general partner or sponsors can profit. As you can see from our example above, when a 6% preferred return is included in the real estate syndication structure, the first 6% of profits go directly to passive investors before the syndication’s general partners. The general partners will only profit if the syndication’s return is above 6%.

By including a preferred return in the waterfall structure, the general partners are incentivized to not only reach the preferred return but exceed it because the preferred return must be paid to investors before the sponsorship team can profit.

After the preferred return has been reached, the next phase of the waterfall structure is activated.

As you can see from our example above, profits between 6-15% would be structured in an 80/20 split with 80% profit to investors and 20% of the profit to the general partners.

If returns of the real estate syndication exceed 15%, the waterfall structure will break into a 50/50 even split between investors and general partners.

A waterfall structure can incur different splits based on the return thresholds met so its important to fully understand each hurdle outlined in the offering memorandum.

What is the Best Real Estate Syndication Structure?

The reality is that there is no one way to invest in real estate syndications, and depending on the performance of the syndication, one structure may generate better returns than the other.

Many factors must be considered to decide if an investment is right for you. As a passive investor, you will want to understand the return thresholds and ensure the splits match up with your real estate investment goals.

Overall, passive investors prefer preferred returns as it provides safety on their return and accountability to their real estate syndication company.

Additionally, preferred returns allow for passive investors to achieve more stable yearly passive income.

Final Thoughts on Real Estate Syndication Structures

Real estate syndications are incredibly lucrative investment opportunities. They are a great way to diversify your portfolio, but please remember that no specific real estate syndication structure will guarantee you high returns.

As you can see from our examples, real estate syndication structures have a large impact on investor returns, making it imperative that you understand how the syndication is structured before you invest.

One of the most important aspects of investing in a real estate syndication is picking the right real estate syndication company that you like, know, and trust.

Along with partnering with the right team, before investing in a real estate syndication, you want to ensure the investment aligns with your individual goals and risk tolerance.