Depreciation in Multifamily Real Estate: A Comprehensive Guide

Depreciation is a key concept in the world of multifamily real estate that every investor should understand. It’s not just a financial term but a

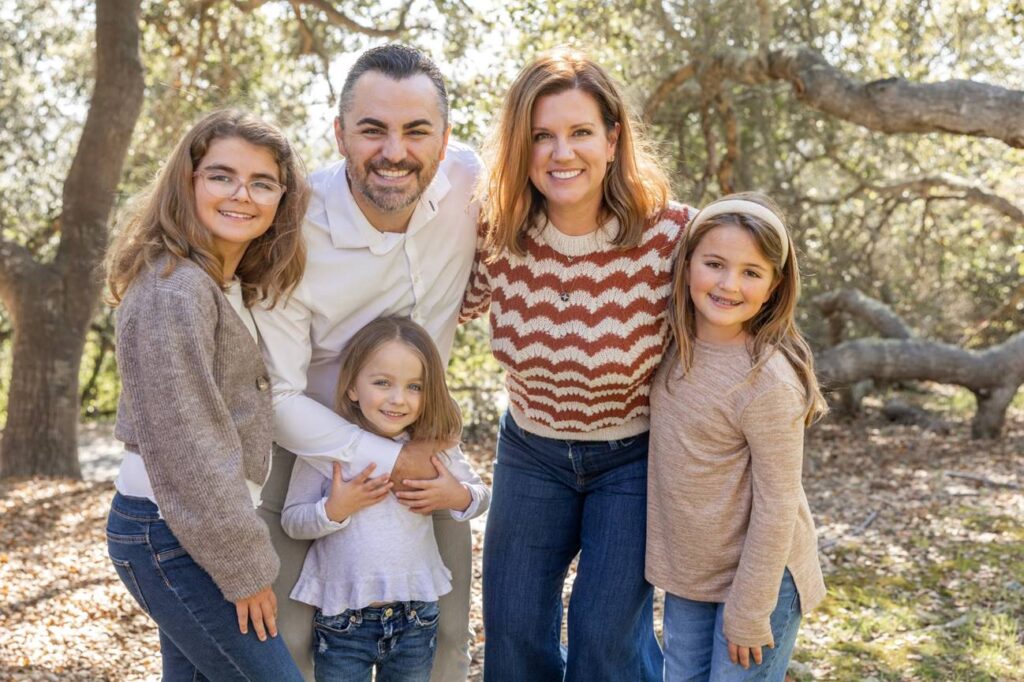

Time. It is our most valuable, deeply personal commodity. It should be spent on the people and things that matter most, enrich our lives, and bring us joy.

Laurence Rose Capital was founded with a simple purpose – to give time back to our clients to live their best lives, meet their personal goals, and build a legacy for their families. We do this through multifamily real estate investments that make sense. We conduct thorough research and leverage an extensive network to provide the best opportunities, while giving you the freedom to capitalize on the investments that work for you.

We help improve your life and the lives of others through a consistent, proven investment approach

We know how to find value-driven assets in growing markets, primarily focusing on under-performing properties. We look for a clear path to growth through simple market factors: population growth, wage and job growth, housing supply metrics, and other location-based data.

We choose underperforming assets and provide improvements that increase the property value while improving the quality of lives of the residents who live there. We operate with transparency and efficiency, ensuring our properties are managed well to realize their full potential.

We strive to provide near-term, positive cash flow based on the rental incomes generated from the property. Long-term it is our aim to increase the equitable value of the property through a predetermined holding period. We have consistently seen returns for our clients at levels that consistently beat stock market averages without the tax disadvantages.

Understand the cycle model and different phases of the U.S.

property market and the strategies for each.

Tucson AZ

77 units

Acquired in Q3 2023

Denver, CO

61 units

Acquired in Q3 2022

North Little Rock, AR

28 units

Acquired in Q2 2022

TUCSON, AZ

28 UNITS

ACQUIRED IN Q1 2022

Bryant, AR

26 Townhome units

ACQUIRED IN Q4 2021

San Antonio, TX

296 Units

Acquired in q3 2021

Umatila, Florida

14 units, 6,000 square feet commercial space

Partnership acquired Q2 2021

Seattle, Washington

230 Units

Acquired in 2018

Columbus, Ohio

10 units

Ownership acquired Q2 2018

Sold after 18-month hold

Gilroy, California

16 units, 8,500 sq ft commercial space

Partnership acquired in Q3 2015,

Sold after 4-year hold

We are seasoned multifamily operators.

We have deep experience in growing markets in the domestic United States.

We make every investment decision to get you to financial freedom.

We are results-oriented – driven by what is best for you, your family, and our family.

We are Laurence Rose Capital – family-owned, putting family first.

Principal

Vince’s real estate experience began early in life. His family has always shared the value of property investments, passing on the knowledge and the assets from generation to generation.

After he graduated from Santa Clara University with a degree in Business Management, he started his career in Risk Management for construction and development. He found himself getting close to different development projects, contractors, and seeing how the property landscape was rapidly evolving in the Bay Area. He started investing in syndications right out of college, seeing the power that equity growth could bring. He eventually became a Partner and Owner at his Brokerage after growing his client base and adding significant value to his firm.

He has built a meaningful network of like-minded real estate entrepreneurs and had success with his acquisitions across the domestic U.S., targeting markets that are poised for growth. He plans to bring the same level of success he has seen from these efforts to his client base at Laurence Rose Capital, so they all can share in the promise of building generational wealth for their families.

Vince is an active Member of the Board on the Santa Clara University Bronco Builders Association, Construction Financial Manager’s Association (CFMA), and United Contractors Association. He is also passionate about giving back, active as a contributing board member with a number non-profit and community organizations aimed at supporting education and healthcare in the Bay Area.

Marketing and Operations

After graduating from Santa Clara University with a degree in Communications, Erin began her career in the cosmetic industry in New York City working in sales and marketing.

After her company relocated to the Bay Area, she found herself immersed in the transformative world of software and technology. In 2011 she joined VMware, supporting Research and Development executives with their internal and external communications strategies. As a trusted advisor to the executive team, she discovered how a great communication strategy drives team alignment and operational efficiency.

In 2015, she joined VMware’s End User Computing Business Unit as the Chief of Staff to the SVP and GM helping him scale to run a $1B business and 4,000-person global team. She left VMware in 2019 to join late-stage start up Instart as the Head of Business Operations and participated in a successful acquisition of the company in 2020. More recently, she has shifted her focus to part-time consulting to focus on building her family business in partnership with her husband Vince.

Her husband’s passion and knowledge of multifamily real estate coupled with Erin’s experience driving results and aligned communication will be the foundation of Laurence Rose Capital.

Strategic Advisor

In 1996, Marco graduated from Fairfield University and turned down a job with GE Capital to go into the restaurant business with his brother Gino. At the age of 23, he bought his first multifamily property, a 4-family, in New York.

In 2013, he began investing with his brother & Jake in Knoxville Tennessee, where they purchased their first twenty-five unit deal. Since then, he has partnered with Jake & Gino and on his own on over 2,500 units and has witnessed and participated in the growth of the company.

Marco exited the rat race in August 2019 and joined the Jake & Gino team full time to help coach students and raise capital for Rand Partners.

Marco excels in networking, building teams and putting people in place to succeed. He is a husband and the father of 3 beautiful girls. His family and multifamily are his two main focuses in life.

Strategic Advisor - Operations & Asset Management

A US Citizen, a full-time real estate investor and an asset manager of a passive income portfolio. Hadar been Investing in Real Estate for over a decade, specializing in long distance, out of state investing.

Started as a Licensed Real Estate agent in Israel before Immigrating to New Zealand in 2003.

Hadar’s portfolio includes Multi-Family apartments, and Commercial Triple Net Leases Real Estate in NZ and the United States.

In the US with MFIHolding.com, Hadar is focused on Multi-Family Apartment Buildings that have value-add upside potential.

Over the years Hadar implemented different strategies which includes wholesaling, house flipping, subdivision, new construction, commercial real estate, joint ventures, and multifamily investing.

Hadar enjoys helping both seasoned real estate investors and those new to real estate investing reach their wealth, income, and portfolio goals through multifamily real estate investing.

Hadar loves real estate investing and the freedom it creates.

Strategic Advisor - Deals

Collin is Co-Founder and Director of Operations for Park Ave Capital, LLC. He directs the day-to-day operations of investments. Collin brings over three years’ experience of investing in the alternative asset class.

Concurrently, Mr. Schwartz is an investor and owner of Bricktown Management, a property management company located in Omaha, Nebraska. Mr. Schwartz has over $60 million in real estate assets and 900 units throughout the Midwest. Mr. Schwartz brings to the company over 50 real estate transactions.

Mr. Schwartz additionally is a real estate investor with CT & Son LLC, investing in multi-family residential real estate in the South and Midtown areas of Omaha. CT & Son currently owns and operates thirty residential units. Prior to his innovative ventures, Mr. Schwartz was a product and marketing analyst for Physicians Mutual.

He is also the creator of the largest real estate meet-up in Nebraska. He is a father to three children, with his wife, Emily. Mr. Schwartz graduated from Bellevue University with his MBA in finance.

Data Analytics/Underwriting

Huan is a skilled underwriter with a background in structural engineering with over 10 years of experience. He is familiar with many building construction systems and is very experienced with managing renovation projects.

Depreciation is a key concept in the world of multifamily real estate that every investor should understand. It’s not just a financial term but a

As you embark on your journey as a passive investor, you’ll encounter a variety of deal structures and investment strategies in the multifamily apartment space.

Investing in multifamily real estate can be a lucrative endeavor, but securing financing for such projects can be challenging. Creative financing offers innovative strategies for

Investing in apartment complexes can be a lucrative venture, but understanding how much profit they can generate requires a comprehensive analysis of various factors. The

Notes:

Website Developed by Marcom18